State of the (FinTech) Nation

8 reasons why I’m optimistic about Consumer FinTech

We’re undoubtedly in a rocky period for consumer fintech businesses. Falling valuations, layoffs, and regulatory issues.

However, I'm not focused on that today.

I spent nearly 8 years at Monzo Bank, first in the UK and then launching our US business, and saw first hand what worked (and what didn’t). More recently I’ve been investing in, and working with, early stage founders and have been reflecting on what I’ve learnt that might increase their odds of success.

I want to paint a more optimistic picture and propose 8 ways to succeed in building, and scaling, new a new consumer FinTech.

There is still a lot of work to do, but I’m excited for the future.

If you are working on something interesting, at any stage, I’d love to talk more.

Something is clearly broken

Let’s start by doing a quick reconnaissance flight to check the status of consumer financial services today. But not from the perspective of balance sheets, share prices or funding rounds. What is it like to be a consumer today?

Brace yourself. I’m not at all convinced that a decade of fintech startups and m(b)illions of dollars of VC funding has improved the customer experience to the extent that we like to believe.

There are obviously bright spots. Some of my proudest moments at Monzo were hearing from customers who told us how they had gotten out of long term debt or improved their mental health through the money management tools that we provided.

But too much of what we’ve put out is absolute garbage, an unadulterated hot mess of bad technology, confusing UX, poor customer support, all held together with sticky tape and (more recently) an AI chatbot that doesn’t know it’s not meant to fall in love with you.

The product experience just… isn’t good enough

When was the last time that you felt really wowed by a banking, payments, or lending product?

Too many product offerings are incomplete and half-baked – apps are confusing and messy. They feel like bloatware. Dark patterns designed to trick you into signing up for a more expensive monthly subscription. Ads for other features taking up real estate on the home screen. Endless notifications and upsells. To further compound the problem we’ve created a disintermediation jumble, and now my finances are spread across 10 products.

And on the other hand, many well established fintechs haven’t shipped anything new, for like a really long time. Sometimes a really, really long time. Here’s the Venmo app from 2010. Sure it looks like a phone screen from 2010. But it basically does the exact same thing as the Venmo app does today. The Manhattan Project was 4 years. It took 10 years to build the International Space Station. There must be people who were early Venmo customers who have since got married, got pregnant, birthed and raised a child, and now that child has signed up for a Venmo account, without the feature set fundamentally changing in the intervening period.

Source: Medium blog: the past and present of Venmo

Customer service sucks – and it’s worse at startups

We seem to have sacrificed good customer service on the altar of “technological progress”. While it’s true of both startups and incumbents, startups have way more to lose. New companies are (hopefully) offering novel products that might require more explaining, and in any case, they’re acquiring new customers who need more help to get onboarded.

For many startups customer support seems like an afterthought. And incumbents are midway through multi-decade technology transformation programs, no longer able to rely on tried and tested branches or call centers, but not fully integrated with chat or automated help options.

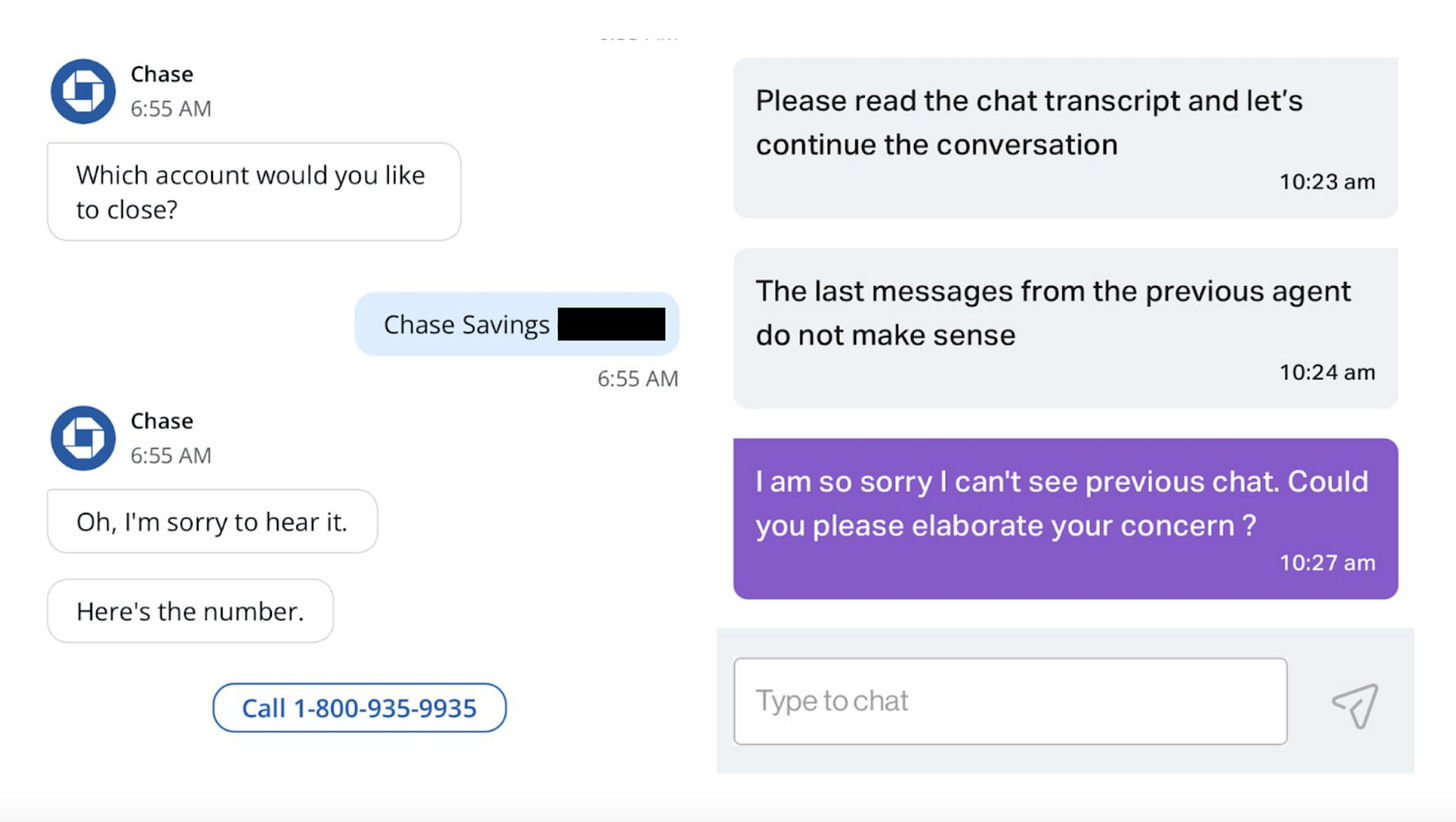

Below are two recent real examples that reminded me that there is still a lot of work to be done: Chase forces me to call their customer support to close a savings account, and Varo makes me repeat a customer support query because their agents cannot see prior conversations.

Why, why, why?

Why is there a gap between what feels possible and what is delivered to us? To steal from Apple, it feels like this should “just work”, but it often doesn’t… We’ve been talking about Brian Cheskey’s “11 star experience” for years. But it doesn’t seem like anyone is listening.

Product thinking has become constrained

Too many products in the market today are “faster horses” focused on iterative improvements to current workflows or services. Or products are “addictive painkillers” – you’ll deal with the negative consequences of using the product just to avoid the one issue that they have solved for you.

In general consumer products get known for one thing, and that one thing sticks. Trying to change public perception of what your product does is hard. That’s why I think it’s important to start with a bold and ambitious vision!

As an example – I just don’t think that the Chime product is very good – the UX is mediocre, the customer support is bad, and the features in terms of money management aren’t great. But Chime doesn’t charge the same fees that big banks charge, and if you are not rich then it’s extremely attractive to avoid being charged $35 overdraft fees. That makes sense. My worry is that Chime’s product is overly reliant and only known for this “hook” of low fees. Competitors might be able to eat into market share if they can build something that combines low fees as part of a more revolutionary product set.

When Apple was working on the iPhone they were obviously responding to clear issues with existing smartphones such as low quality touch screens or poor web browsing experiences. But the product that launched was a much broader solution – the iPhone didn’t just directly address those issues, but created a fundamentally different and better product that customers loved.

Behind the scenes it’s all the same (and it’s garbage)

Incumbents have digitized existing offerings, but “under the hood” many of their systems are stuck in the past. And in the startup world there are now an amazing range of third party offerings to help you get launched quickly (whether that’s partner banks, BaaS, payment processors, etc). However, that causes its own problems – if you are using a third party for some of your offerings you are probably only 2 or 3 levels away from a legacy bank platform, mainframe computer or an excel sheet being used in production.

No matter how great your technology is, if you’re using the same card processor, loan service or partner bank, as 10 other startups, how much are you going to be able to differentiate yourself?

Reliance upon paid growth

Over the past decade many companies have been able to use venture funding (ZIRP!) to pay for growth structures like online marketing or incentive structures (get $20 if your friend signs up!), but have not necessarily had to build truly great products. Building a great product is never enough on its own. But overly relying upon paid channels can disguise the fact that your core product doesn’t have strong organic growth on its own merits.

Monzo proved that products that are genuinely great should not need to rely upon huge sign-up bonuses, top tier APYs or completely free offerings. We spent very little on paid marketing and we didn’t offer other sign-up benefits for years after launch. (See Tom’s blog)

Too many bankers, not enough hackers

Fintech got popular. Not a bad thing per se. But there are a lot more bankers working in FinTech than when I first got involved. I remember a senior executive in the City of London stating: ‘there will never be a billion dollar FinTech bank’. How times have changed.

More bankers joining FinTech firms is not necessarily a bad thing, but amazing products often come from teams without strong preconceived notions of how things should be. The people I’m thinking of are product focused, they’re builders, engineers or amazing designers. They’re a very different breed from people trained in institutional organizations. Bankers crush the spirit of Hackers. Consensus building versus an individualistic mission. Planning and strategy versus testing and building. Avoiding failure versus the chance of success. Saving face versus embracing conflict. Stakeholder management versus calling out BS.

There is a natural tension here – there are very large profit pools in Finance (bigger than ever – JPMorgan Just Made More Annual Profit Than Any US Bank Ever), so even relatively incremental products, built by experienced financial services professionals, may be able to build successful businesses!

In my experience it’s relatively easy to teach someone with the hacker mindset about financial services regulation, balance sheets and reconciliation. It’s almost impossible to teach most bankers about iterative product development, user feedback cycles or GitHub...

So…What to do?

It’s clear that things are incredibly tough if you’re starting something today. There are many great products for customers to choose from and the market is insanely competitive. You are competing with both customer resistance to change AND very profitable traditional banks / financial services companies AND AND AND other well funded tech companies.

Wouldn’t it be easier to build a SaaS company or launch an AI infrastructure company or just invest in the S&P 500? To be honest, maybe. But some of us are suckers for punishment and its fun when it works.

To be successful I think you need more than a great product or lower fees. This is my take on 8 attributes common across the most successful teams building consumer fintech products. I think that you should have at least 4 or 5 of the below, and ideally closer to 6 or 7:

A unique insight about customer needs or product construction

What do you know that no one else knows? Some founders have worked on a related problem at a prior company, or even developed an internal tool, others experienced the problem first hand as a user and identified an opportunity that others weren’t aware of.A highly opinionated product, design, brand and tone of voice

Something that makes you stand out from the crowd (and likely means you're not for everyone). For Monzo this was one of the things that we obsessed over during the early days. The hot coral debit card is what we’re best known for – it was eye-catching and created a conversation (even if it was never meant to be a permanent design!). Our first Head of Design was a champion of quality – ensuring that our bar was incredibly high. Occasionally I look back at the first version of our app, which was barely more than 2 screens, and marvel at the simplicity and ease of use:This was basically the entire product in 2016! Source: Monzo blog

A unique distribution model

This is really just part of product market fit – finding a way to reach your customers at the place where they “are” and at the time that they are looking to “buy” your product. Some approaches might be partnership based (e.g. relationships with incumbent FIs, payroll companies or healthcare providers), and others could be based on thinking creatively about how to find “your people” whether online or IRL. CashApp is an amazing case-study here, they identified that African American communities were typically not served or targeted by either traditional FIs or startups like Venmo.Moving blazingly fast to give yourself an unfair advantage

Being fast is an amazing compounding advantage. It makes your team feel like they’re winning, it shows your customers that they’re part of a “movement” and it drives positive investor sentiment.

Plus moving fast gives the ability to be first. In a highly regulated industry like finance, being able to be the first to respond to regulatory or legal trends and changes can give you a huge advantage against competitors.

There will be continued turmoil as a result of financial services regulation catching up with the last decade of innovation. This creates opportunities for confident and well informed founders to take advantage of changing regulations (examples might be FedNow or the potential changes to open banking from the CFPB). If you see an opportunity move fast – a big part of success might come from simply being first.

To quote Jeremy Irons: ‘There are three ways to make a living in this business: be first; be smarter; or cheat. Now, I don't cheat. And although I like to think we have some pretty smart people in this building, it sure is a hell of a lot easier to just be first.’ (Margin Call, 2011)

The confidence and risk appetite to take risks and do things differently

As a startup one of your only advantages versus incumbents is the risks that you can take versus the risks that they cannot take. Act like pirates, do things that don’t scale, hack an MVP together, ship products early and often, move fast and break things. You can take considered reputational, compliance and legal risks. You can bitch about your competition, you can build on top of undocumented APIs, you can get away without having signed contracts. I loved the original marketing from Wise (née Transferwise) – they would do crazy stunts like put billboards outside the HQ of big banks calling them out for high FX fees. I can’t say whether it worked or not, but it created a strong brand identity – here was a company that was a friendly face, that didn’t take itself too seriously.A really powerful hook or wedge feature

Something that is compelling enough to encourage users to sign up / get started etc. Early on Robinhood found that offering fee free trading was a great wedge to start acquiring initial customers (here’s their website from 2014). Then later they built out a wider range of features including banking, crypto and retirement.

Source: Wayback Machine

Building unique technology to give you unique abilities

It’s easier than ever to cobble together your product with less engineering work than at any time in the past. But think carefully about what parts of your stack you need to innovate in and which can be commoditized. If you think about the products that have made the biggest impact in FinTech in recent years, I think it’s clear that most of them have unique technology that helps them stand out from others. For example – when Plaid launched there were few existing APIs for pulling data from Banks. Plaid built screen scraping from scratch because there was literally no other option for them to build that product experience. Not every team will need to build all of their own technology, but it’s a good idea if it will help you unlock unique products that your competitors can’t offer.

Build human products, supported by technology (not technology products supported by humans)

Human interaction is undervalued by tech startups. Whether as part of customer support, issue or complaint resolution, onboarding or internally facing in terms of how you build your team (remote, hybrid, in person). Customer Operations was the secret weapon at early Monzo. The experience of getting high quality customer support, 24/7 and sometimes from the CEO himself, felt like a revelatory experience for many early customers. We empowered those early hires to actually solve problems for customers. Users would report issues, and then hear back from engineers who had shipped changes that same day. Early employees hand delivered cards to customers who had lost them. And we booked taxis or sent flowers when things went wrong. Now we’re entering an experiential age, where true human interaction will stand out in a digital world. For the big moments a screen of confetti or a sad face emoji isn’t enough.

I’ll be dedicating the majority of my time post Monzo to working with and investing in early stage Fintechs. I’m a long term optimist that believes that great products that solve real customer needs can be successful. If you’re working on something in this space let’s chat.

Thanks to Jerry Lu, Armen Meyer, Will White, Manuela Rios and Alex Kotran for reading drafts of this blog and your invaluable feedback and thoughts.